Digital payment solutions are transforming the way we conduct transactions. Gone are the days of fumbling for cash or writing checks. In our fast-paced world, convenience and speed have become paramount. Enter Pasonet, a cutting-edge digital payment platform that’s poised to revolutionize how we manage money.

Imagine making purchases with just a few taps on your smartphone. Imagine seamless transfers between friends, family, or businesses without any hassle. As more people embrace technology in their daily lives, Pasonet stands out as a beacon of innovation in this burgeoning landscape.

This blog post will delve into what makes Pasonet unique and explore its features that cater to various users’ needs—from individuals seeking convenience to businesses aiming for efficiency. Join us as we navigate through the future of digital payments and discover why Pasonet is set to lead the charge!

How Does Pasonet Work?

Pasonet operates through a seamless integration of technology and user-friendly interfaces. At its core, it connects users to various payment channels, allowing transactions to be executed with just a few taps.

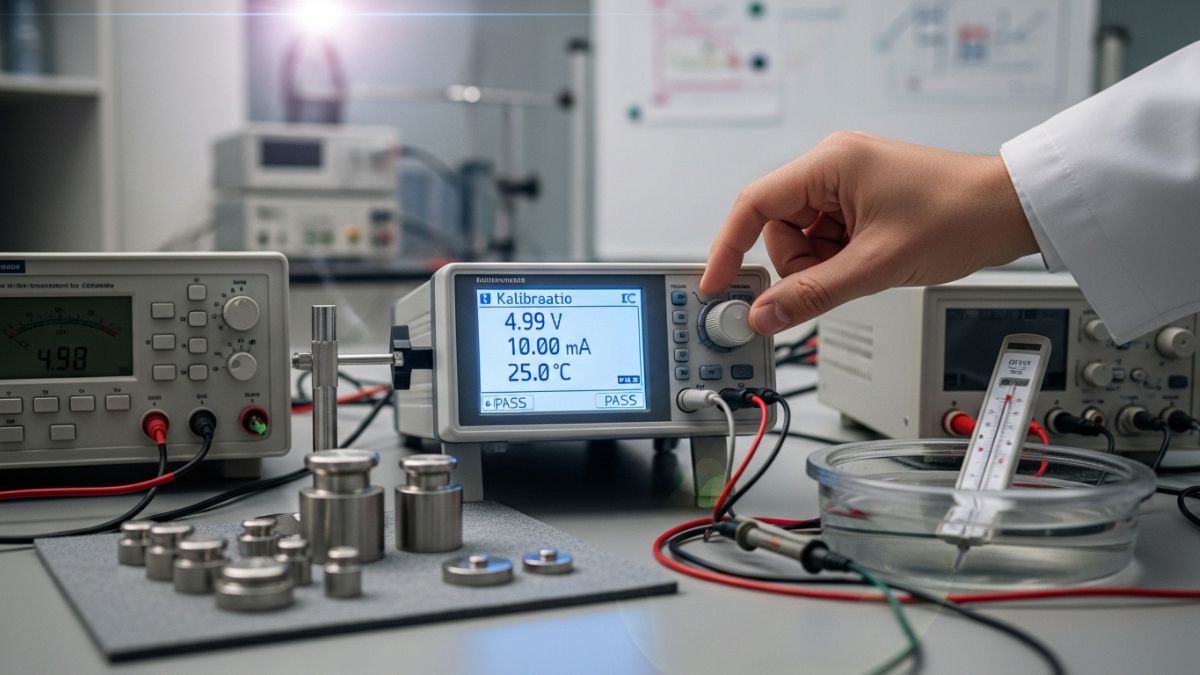

When you initiate a transaction using Pasonet, the system verifies your identity through secure authentication methods. This ensures that only authorized individuals can make payments or transfer funds.

Once verified, funds are transferred electronically from one account to another within seconds. Users receive instant notifications confirming the success of their transactions.

The platform continuously updates its systems to enhance speed and efficiency. This commitment helps maintain smooth operations even during peak usage times.

Additionally, Pasonet allows for easy tracking of all transactions in real-time. Users can monitor their spending habits or manage budgets more effectively through this feature.

Benefits of Using Pasonet

Using Pasonet offers a range of advantages that cater to both businesses and consumers. One standout feature is its speed. Transactions occur almost instantly, allowing users to complete payments without unnecessary delays.

Convenience plays a crucial role as well. With Pasonet, you can manage your finances from anywhere at any time. This flexibility empowers users to make transactions seamlessly on the go.

Moreover, Pasonet supports multiple currencies and payment methods. This versatility appeals to international merchants and customers alike, making cross-border payments simpler than ever.

Cost-effectiveness is another key benefit. Lower transaction fees compared to traditional banking solutions lead to significant savings over time for businesses operating online.

The user-friendly interface enhances the overall experience too. Even those who are not tech-savvy find it easy to navigate through various features offered by Pasonet, ensuring accessibility for everyone interested in digital payments.

Security Measures of Pasonet

Pasonet prioritizes security, implementing advanced measures to protect user data and transactions. It uses encryption technologies that safeguard sensitive information during transfers, ensuring your financial details remain confidential.

Additionally, Pasonet employs multi-factor authentication. This adds an extra layer of protection, requiring users to verify their identity through multiple steps before accessing their accounts. This significantly reduces the chance of unauthorized access.

Regular audits and monitoring systems are in place as well. These help detect any unusual activity promptly, enabling swift responses to potential threats or breaches.

Furthermore, user education plays a vital role in Pasonet’s security strategy. The platform provides resources and tips on how individuals can protect themselves from phishing scams and other malicious attempts online.

With these robust security protocols, Pasonet aims to build trust among its users while providing a seamless digital payment experience.

Comparison to Other Digital Payment Solutions

Pasonet stands out in the crowded digital payment landscape. Unlike traditional options, it leverages advanced technology to facilitate faster and more secure transactions.

When comparing Pasonet to platforms like PayPal or Venmo, its unique features shine. While these services offer convenience, Pasonet emphasizes user privacy and lower transaction fees. This makes it particularly appealing for businesses looking to maximize profit margins.

Moreover, Pasonet’s interface is designed for simplicity. Users can navigate through features effortlessly without feeling overwhelmed by complexity.

In terms of integration, Pasonet seamlessly connects with various e-commerce platforms, making it a versatile choice for online merchants. Its adaptability sets it apart from many competitors that often require extensive set-up processes.

As digital payments evolve, those using Pasonet might find themselves at the forefront of technological advancements in this space.

Future Potential and Expansion Plans for Pasonet

Pasonet is poised for a bright future, with ambitious plans on the horizon. The digital payment landscape is evolving rapidly, and Pasonet aims to stay ahead of the curve.

To expand its reach, Pasonet is focusing on partnerships with local businesses and global e-commerce platforms. This strategy will enhance user accessibility and integrate seamlessly into everyday transactions.

Moreover, advancements in technology play a crucial role in Pasonet’s growth. Implementing AI-driven analytics can optimize user experience by offering personalized services and fraud detection mechanisms.

Exploring international markets presents another opportunity for Pasonet. By adapting to various regulatory environments, it can cater to diverse consumer needs across borders.

Continual innovation remains at the core of Pasonet’s philosophy. Regular updates and feature enhancements will ensure it stays relevant amidst fierce competition in digital payments.

Conclusion:

Digital payment solutions have rapidly transformed the way we conduct transactions. As consumers increasingly seek convenience and speed, services like Pasonet are stepping into the spotlight. By simplifying payments through a user-friendly interface, Pasonet is making waves in the financial technology landscape.

Pasonet operates by securely linking users’ bank accounts or credit cards to their platform. This seamless integration allows for quick transfers and purchases, providing an efficient alternative to traditional payment methods. The ease of use makes it appealing for both individuals and businesses alike.

Using Pasonet comes with numerous advantages. Users enjoy instant transactions without hidden fees or long wait times associated with traditional banking methods. Its compatibility across various platforms adds flexibility, allowing customers to pay at multiple touchpoints effortlessly.